Investing in public graphene stocks - Page 18

German chemicals specialist Evonik invests in Chinese graphene battery materials developer SuperC

German chemicals company, Evonik, has invested an undisclosed sum in China-based battery specialist SuperC.

The Chinese company produces graphene materials for, among other applications, lithium-ion batteries. The materials are said to have the potential to solve key limitations of electric vehicles and accelerate the shift to climate-friendly mobility.

Avadain kicks off second crowdfunding round to raise up to $3.6 million

U.S-based graphene technology licensing company, Avadain, recently launched its second

crowdfunding round to raise up to $3.6 million on the Netcapital funding portal. This follows

raising over $600,000 in January from angel groups Harvard Business School Alumni Network and Keiretsu Forum, and $1.36 million in its first crowdfunding round last year. Avadain also attracted a $3.87 million government grants in 2022.

Avadain says it is the only company known to have a technology capable of manufacturing large (50-100 microns), thin (2-5 atomic layers), and nearly defect free graphene flakes cost-effectively in industrial volumes.

Global Graphene Group's Honeycomb Battery merges with a SPAC company in a deal worth over $900 million

Global Graphene Group (G3) announced that its subsidiary Honeycomb Battery is set to merge with a SPAC company (Nubia Brand International Corp.) in a deal worth $925 million. Nubia's current valuation is $700 million, and following the merger Honeycomb Battery will become a public company that trades at the NASDAQ (ticker: NUBI), with around $118 million USD in cash.

Honeycomb Battery developed several next-generation battery technologies, which include Li-Metal batteries, Li-S batteries, silicon anodes and graphene enhanced cathode materials. The company also developed a solid-state battery technology.

Haydale receives $312,930 Innovate UK grant

Haydale Graphene Industries has been awarded GBP258,547 (around USD$312,930) of funding by Innovate UK, the UK's innovation agency.

Haydale will use the funding to develop imaging techniques to characterize 2D materials, including graphene, to improve the compatibility and material selection processes. The Company explained that current methods for characterizing 2D materials for use in application are "time consuming." It noted that the program will have access to graphene in every format from raw material to finished product to develop new techniques not used before to image a range of nanomaterials.

Northern Graphite acquired an ownership stake in NeoGraf Solutions

Graphite miner Northern Graphite announced that it has acquired an ownership interest in NeoGraf Solutions. Northern has a six month option to acquire an effective 50.1% voting interest and a 33.3% equity interest in NeoGraf and also has an option to increase its interest up to 100% at a later date.

NeoGraf, which is producing graphite and graphene materials, is one of Northern Graphite's largest customers. Northern Graphite says that this investment will enable Northern to integrate downstream into the manufacturing of graphite products for a number of high-growth markets including lithium ion batteries/EVs, fuel cells, graphene and nanomaterials, thermal management in consumer electronics, smart building products and fire retardants.

Bedimensional closes a second €10 million investment round

BeDimensional, a spin-off of the Graphene Flagship Partner Italian Institute of Technology (IIT), has announced its second €10 million Series B investment round, which was led by CDP Venture Capital through the Evoluzione fund, with Novacapital - holding company focused on innovative ventures - and Eni Next - the Eni's Corporate Venture Capital company.

Following the entry of shareholder Pellan Italia in 2018, the company will benefit from this new round of financing to strengthen its industrial activity, expand human resources with high-level professionals and leverage the vast networks of new partners to consolidate and accelerate commercial growth.

G6 Materials announces its latest financial results

G6 Materials Corporation announced its latest quarterly results for the quarter that ended on November 2022. Revenues increased to $490,527 (up from $320,204 last year) and net loss was $911,886, up from a net loss of $610,265 last year.

Gross profit, however, increased from $39,383 to $201,471 primarily due to a change in product sales mix. In July 2022, G6M announced the launch and immediate availability of the Breathe+ Pro Advanced Antimicrobial Graphene Air Filtration System.

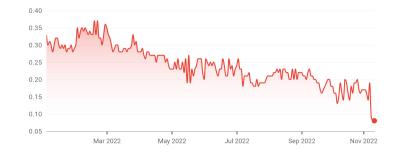

Applied Graphene Materials says its shares will stop trading soon as it still searches for a buyer

In November 2022, Applied Graphene Materials (AGM) announced that it aimed to raise money to fund its operations, but was unable to do so. AGM Later said it received non-binding indicative proposals for its sale.

AGM now announced that trading in its shares will be suspended from next Wednesday (February 1st) as the company confirmed it will not publish its reports by the market deadline. The company has until the end of February before it runs out of money.

Applied Graphene Materials updates on ongoing talks with potential interested parties

In November 2022, Applied Graphene Materials (AGM) announced that it aimed to raise money to fund its operations, but was unable to do so. A month later, AGM said it received non-binding indicative proposals for its sale or the sale of its main operating subsidiary. Now, AGM updated on its continuing discussions with various parties that had submitted non-binding indicative proposals for either the sale of its trade and assets, or of shares in its main operating subsidiary.

The AIM-traded company initially sought non-binding indicative proposals from interested parties with a view to completing a transaction by the end of January. It later said that completing a transaction on a solvent basis would likely require shareholder approval at a general meeting, as well as other regulatory approvals.

Graphenea reports financial figures for 2022 with 34% growth rate

Graphenea recently released its financial results for 2022, highlighting an impressive growth rate and the successful launch of a new business.

Consolidated revenue for 2022 amounted to €4.18 million , reflecting a 34% year-over-year growth rate. Additionally, the Company achieved a positive EBITDA of €0.78 million , demonstrating a strong financial performance.

Pagination

- Previous page

- Page 18

- Next page